401k annuity calculator

This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution and. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are.

Present Value Of An Annuity Calculator Date Flexibility

Please use our Annuity Payout.

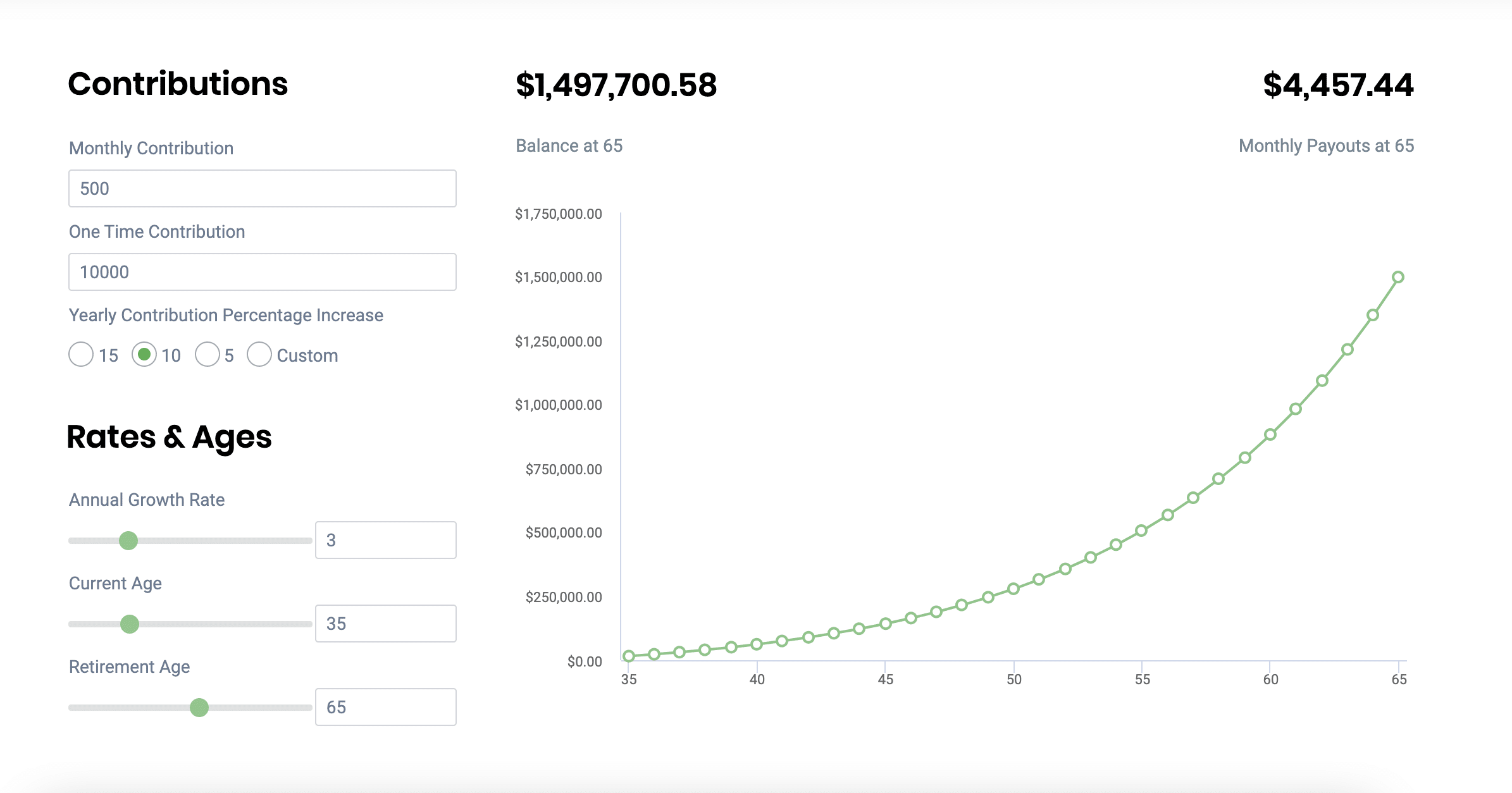

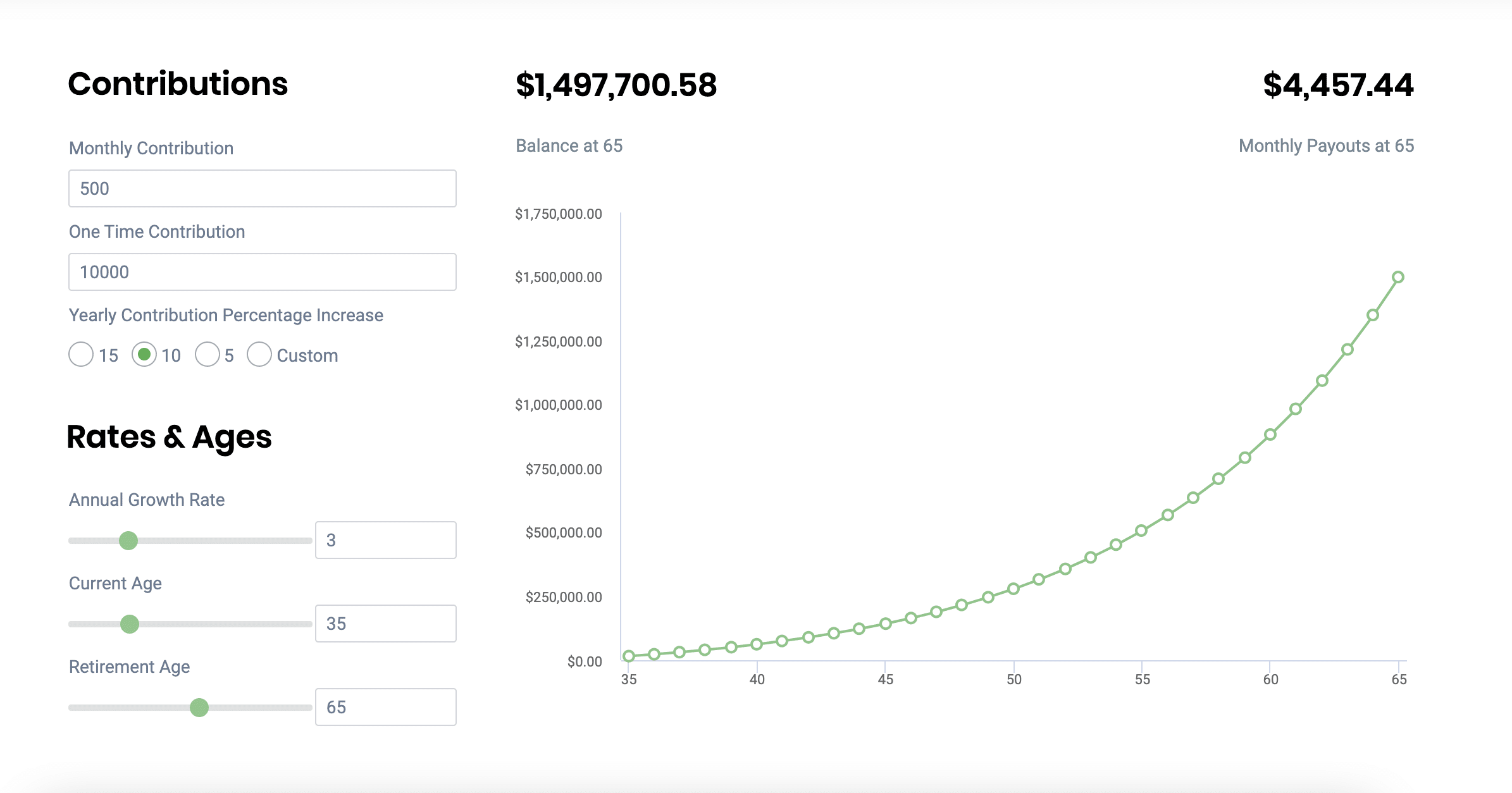

. Another risk to consider when rolling over your 401 k into an annuity. Our 401 k Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 k retirement account by the time you want to retire. That also means that if your 401k investment.

There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks. A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. CBN Your 401k existing balance ROI Annual interest rate YMC Your personal monthly 401k contribution EMC Employers monthly 401k participation ADI Average inflation rate Total.

Please visit our 401K Calculator for more information about 401 ks. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. If the market goes down annuity payments keep coming.

Choose the appropriate calculator below to compare saving in a 401 k account vs. IRA and Roth IRA In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. Annuity Calculator An annuity is an investment that provides a series of payments in exchange for an initial lump sum.

Annuity Calculator The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Divide this answer by the annuitys growth rate. It also considers personal factors such.

Annuity Payout Calculator This calculator can estimate the annuity payout amount for a fixed payout length or estimate the length that an annuity can last if supplied a fixed payout amount. Multiply this factor by the annual contribution to the 401 k. The tax implications of the rollover itself.

While the IRS allows for tax-free rollovers from qualified. A 401 k is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks often with a partial match from their employers. Subtract 1 to get 0791.

Continuing the example divide 0791 by 006 to get 1318. SCHWABS MINIMUM FOR ANNUITY CONTRACTS Designed to ensure we are operating at the. Use this income annuity calculator to get an annuity income estimate in just a few steps.

Fixed Annuity Calculator A Fixed Annuity can provide a very secure tax-deferred investment. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. This calculator will compare the consequences of taking a lump-sum distribution of your 401 k or IRA versus continuing to save it in or roll it into a tax.

401 k IRA Rollover Calculator. The same cant be said of a 401k which is subject to market cycles. Thats calculated with an annual rate of return calculator with inputs of 30 years 100000 initial investment and 5832 annual annuity payment which is 12 times the 486.

With this calculator you can find several things.

Free 401k Calculator For Excel Calculate Your 401k Savings

Annuity Payout Calculator

Annuity Calculator Due

401k Calculator

Future Value Of Annuity Calculator

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

Annuity Calculators Due

The Best Annuity Calculator 17 Retirement Planning Tools

401 K Plan What Is A 401 K And How Does It Work

Annuity Calculator Due

The Best Annuity Calculator 17 Retirement Planning Tools

401k Calculator With Match Online 55 Off Www Alforja Cat

Present Value Of An Annuity How To Calculate Examples

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

Annuity Calculator Due

Annuity Taxation How Various Annuities Are Taxed